If you have never been a victim of identity theft, consider yourself lucky.

For those individuals and businesses that have fallen victim to this ever-growing crime, the results can be quite devastating.

While you may travel through your entire adult life without ever succumbing to identity theft, you might have some close calls along the way.

One of the ways to lessen the chances of being an I.D. theft victim is making sure you are practicing commonsense tactics each and every day as it pertains to your personal life, notably your finances.

For instance, one of the ways to go about defeating identity theft is by making sure you are covered by an identity theft protection provider.

Such a company can monitor your credit cards, bank accounts, online activity, searching for anything out of the ordinary. If it does come across something suspicious, you can be alerted at a moment’s notice.

With that in mind, are you going to do all you can to gain a victory against identity theft?

Be Cognizant of Your Personal Surroundings

While there are myriad of ways to be on the defensive against identity theft, taking a more pro-active approach is oftentimes recommended.

For example, do you routinely take proper care of your credit cards, bank statements, and Social Security papers? If not, you are putting yourself (and your financial well-being) in a dangerous spot.

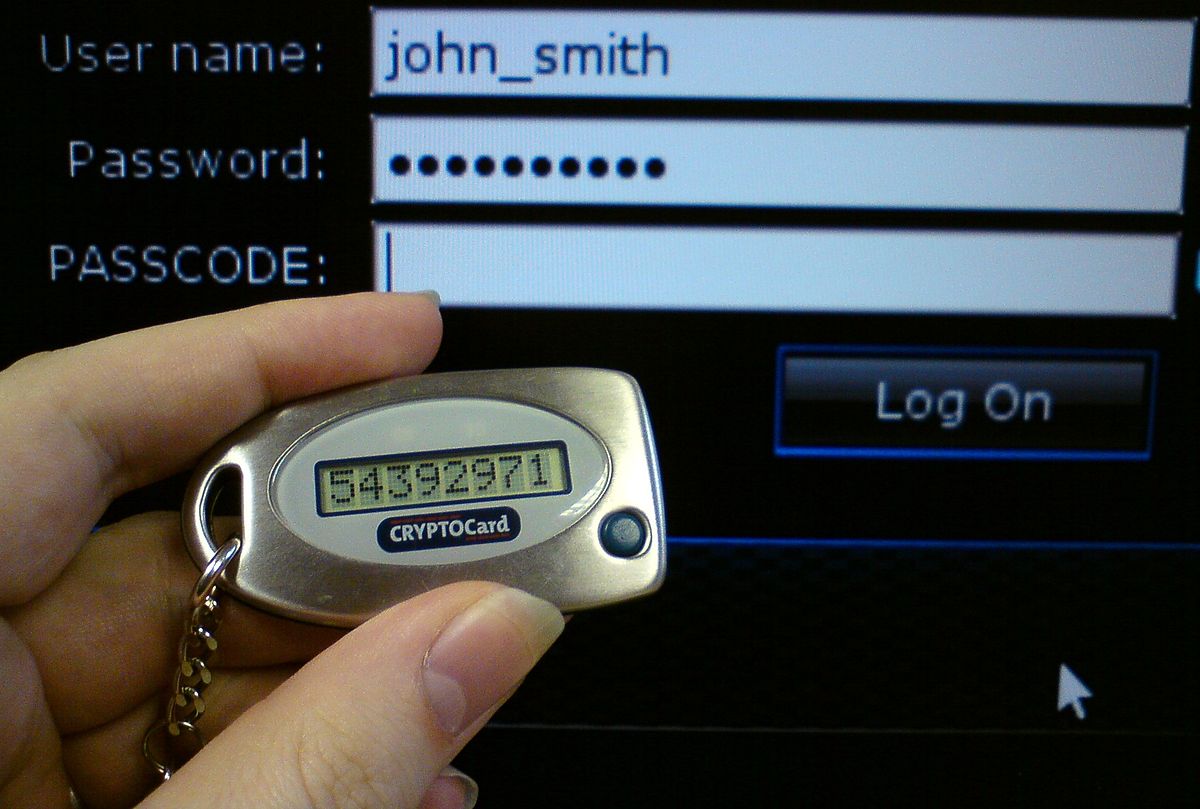

With more consumers going the online route these days to conduct some or the majority of their financial business, it is imperative (if you are one of them) that you make sure your website is as secure as can be from hackers.

For instance, do you notice strange occurrences when it comes to how your computer is acting these days? Unbeknownst to you, you could have gotten a virus on your machine by simply downloading something you thought was safe. As a result, someone could be monitoring your machine right at this moment.

If you feel suspicious about anything involving your laptop or desktop, have it checked out, looking to see if someone has in fact breached your layer of security.

Are All Computers You Use Truly Safe?

Another important piece of the protection puzzle is not working off of computers that you can’t with 100 percent certainty say are safe to the best of your knowledge.

As an example, you go on a trip (be it for business or pleasure) and spend some time in a hotel.

From there, you decide to use the hotel computer in the lobby or business center. You get on there and share some personal client data with another co-worker via email etc. Stop and think for a moment, are you 100 percent sure that you had a secure connection?

In most cases, you probably did have security backing you up. In other instances, however, a hacker may have tapped into the hotel’s network system, making it void of security. Once that information you put out there is taken by an identity theft thief, he or she can do multiple things with it, none of which are good. In protecting your website against hackers, always assume someone could be monitoring your online activities.

One other important task that you should never lose sight of is making sure you properly dispose of any financial paperwork once done with.

As an example, don’t take a mound of credit card receipts and just dump them in the garbage can.

Any such receipts should be properly shredded, thereby removing the threat of someone rifling through your garbage looking for identification markers.

The same holds true for bank account and Social Security statements, credit card offers you receive in the mail, and of course any paperwork that has your personal medical records on them.

In today’s world, more and more thieves are swiping personal medical records, only to turn around and sell the data for profit.

Yes, it sounds like there is much to guard against in today’s fight against identity theft, but do you really have any other choice?

The war against identity theft is winnable, but you’re going to have to put some time and effort into such a war.

That said are you ready to gain such a victory?